NetWatch OSINT critical in UK's largest fundamental dishonesty judgement to date

Learn more about the OSINT work undertaken by NetWatch which proved pivotal in securing the UK's largest fundamental dishonesty verdict to date - and a £6.6m saving for the insurer

David Purcell

COO

Learn more about the OSINT work undertaken by NetWatch which proved pivotal in securing the UK's largest fundamental dishonesty verdict to date - and a £6.6m saving for the insurer

Avid followers of insurance claims judgements (and many casual observers!) will have seen and taken note of the excellent recent verdict in favour of Keoghs and Hastings Direct to dismiss a £6.6m claim on the basis of fundamental dishonesty. This is thought to be the highest value claim dismissed in the UK. We're not here to provide a write up of the case, multiple parties have done a great job of that already, and Keoghs' own write up available here is well worth a read.

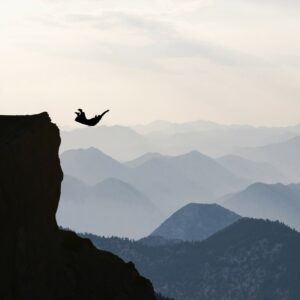

This is a case though in which open source intelligence (OSINT) evidence obtained by NetWatch played a pivotal role, leading the judge to accept as a matter of fact that the claimant was likely to have performed a BASE jump in Italy, and critical in the ruling. Obtaining powerful OSINT evidence on a fundamentally dishonest character is not straight forward - and initial work certainly did not pick up this key piece of evidence.

Why is social media evidence hard to obtain on fundamentally dishonest claimants?

Well, a fundamentally dishonest argument indicates that the claimant has been dishonest, with that dishonesty permeating the whole claim - and certainly its core arguments, with many aspects being exaggerated.

It is well known that when submitting a high value insurance claim a claimant will often be advised by their solicitors that they may be investigated. Over time it has become common knowledge that these investigations are likely to include social media, and physical surveillance.

Investigators and insurers are used to seeing claimants change their privacy settings, delete accounts or even selectively remove posts. If this sort of thing starts happening it's a good indication that elements of the claim may be exaggerated, or the claimant may have something to hide - but hey, they could just not like the idea of people rooting around and looking at their posts.

It stands to reason that anyone who sets out to exaggerate a claim, a person who is fundamentally dishonest, is highly likely to fit into the above bracket.

How can getting OSINT right early on pave the way for a fundamental dishonesty verdict?

A good open source investigation is always a great way to start your investigations of any case, be it insurance or otherwise. It gives you some low cost objective information to make early decisions, be they for further investigation, settlement or otherwise.

Critically in an insurance claim getting this done early often gives insurers a head start in gathering intelligence before the other side has had chance to consider how their online footprint may impact any claim they are making. This gives the insurer a clear, pure and unfiltered view of the subject.

Moreover, it is extremely interesting to wait and see what happens as the case progresses. In large and high value cases its always worth a second social media and online review taking place later down the line. If, as was the case in our investigations here, profiles are deleted, made private, and or selectively trimmed - then both eyebrows and red flags can start to be raised.

In this case, when we revisited the subject - profiles that could not easily be made private, such as Facebook, had been deleted, others made private or remained so. Whilst this does limit the potential avenues for future online investigations it does give an indication that the subject may have something to hide.

We frequently revisit profiles in many cases and see that profiles have been edited, potentially harmful images deleted from Instagram profiles and so on. In being able to evidence this as it unfolds the insurer has another important weapon in showing a claimant to be dishonest.

Where can you take an OSINT investigation when profiles are private and accounts deactivated?

OSINT investigations don't have to just end when you hit the brick wall of deleted and private accounts. However, you'll often need a good reason to take things further as costs will inevitably start to build, without the guarantee of any useful return on investment.

In this case there was enough suspicion to warrant additional time being spent on the case in the hope that a needle could be located in a haystack. NetWatch spent time understanding the claim further on calls with Keoghs and Hastings to suggest a way forward.

The claimant was known to enjoy extreme sports and in particular BASE jumping. One of several solutions proposed by NetWatch was to locate social media accounts for ALL nearby associations offering BASE jumping and associated services and review all content relating to these accounts post incident. The intention being to try and ascertain any indication the subject was still participating in the sport.

This would usually be far outside the scope of any initial investigation, given the likely hours required versus chances of success. However, OSINT can often deliver the goods if you're willing to put in the groundwork and search for those needles in haystacks - and in this case it did.

Through hours of investigation it was the location of one photograph, of the subject carrying BASE jumping gear in Italy, which proved pivotal to the case outcome and led the judge to conclude the claimant had jumped on that day.

Closing Thoughts…

It is highly unlikely that this level of extra work would have been undertaken without the diligence and persistence of the legal team at Keoghs and claims handlers at Hastings in building a robust case.

Mike Pope, Partner at Keoghs highlighted the value of the work undertaken by the NetWatch team: "The NetWatch OSINT product proved to be a critical piece of evidence in this case. Intel reports commissioned from other suppliers are unlikely to have uncovered the photograph taken of the claimant in the BASE jump landing zone. Success at trial depended on several factors, including OSINT, and involved a collaborative approach between Hastings Direct, Keoghs, and NetWatch."

David Purcell, Chief Operating Officer at NetWatch praised the hardworking NetWatch analysts for success on the case: "Ultimately Open Source Intelligence is only as good as the analysts doing the work, we spend an awful lot of time training our team, but in cases like this it comes down to the diligence and hard work of individuals in persisting that trawl through hours of images looking for the silver bullet. That's exactly what Laura Iveson has had to do in this case, but thankfully its paid dividends for our client."

NetWatch continue to work with insurers on a variety of cases to provide a range of open source intelligence and investigation services - and the team are always available to discuss anything slightly out of the ordinary or requiring that little bit more.